There’s a significant difference between simply owning a few rental properties and strategically building a true property portfolio. One is a collection of assets; the other is a powerful, coordinated system designed for growth. A well-built portfolio generates its own momentum, where the income and equity from your current properties help fund your next purchase. This creates a snowball effect that can dramatically accelerate your journey toward financial independence. Learning how to grow your property portfolio is about mastering this cycle of reinvestment. In this guide, we’ll cover the proven strategies for financing, property selection, and risk management that turn a simple buy-to-let into a thriving collection of investments.

Key Takeaways

- Start with a Clear Strategy: Before you look at listings, define your investment goals and get your finances in order. A solid plan is your roadmap, helping you make confident decisions and choose properties that align with your long-term vision for wealth.

- Use Your Properties to Fund Growth: The fastest way to scale is by making your assets work for you. Learn powerful strategies like the BRRRR method and refinancing to tap into the equity you build, allowing you to reinvest your capital and acquire more properties without starting from scratch each time.

- Protect Your Portfolio with a Professional Team: Don’t try to do everything yourself. Mitigate risk with the right insurance and legal advice, and build a network of experts like property managers and accountants to handle the day-to-day, freeing you up to focus on strategic expansion.

First, Let’s Cover the Basics

Before you jump into expanding your property collection, it’s important to get clear on the fundamentals. Building a successful portfolio starts with a solid foundation of knowledge. Understanding what a portfolio is, why you should grow one, and what your personal goals are will set you up for making smarter, more confident decisions down the road. Think of this as your strategic starting point—the essential first step before you start scouting for your next investment.

What is a property portfolio?

Think of a property portfolio as your personal collection of real estate investments. It’s more than just the home you live in; it’s a group of properties you own to generate income and build wealth. This collection can include a variety of assets, such as buy-to-let homes that provide a steady rental income, houses you purchase to renovate and sell for a profit (often called “flips”), or even shares in Real Estate Investment Trusts (REITs). The key is that each property is an asset working for you. Your portfolio is a clear measure of your real estate investments and their collective performance.

Why grow your portfolio?

Growing your property portfolio is one of the most effective ways to build long-term wealth and create a secure financial future. Each property you add has the potential to generate rental income, which can create a reliable stream of passive cash flow. Beyond monthly income, properties tend to appreciate in value over time, increasing your net worth. A diverse portfolio with multiple properties can also provide stability. If one property is vacant, the income from others can help cover your costs. This strategy helps you build a resilient financial foundation that can weather market shifts and move you closer to financial independence.

Define your investment goals

Before you start your search, take a moment to figure out what you want to achieve. Your investment goals will act as your roadmap. Are you aiming for immediate cash flow from rental income, or are you focused on long-term appreciation? You also need to be honest about how much time and effort you can commit. If you prefer a hands-off approach, you’ll want to factor in the cost of a great property manager. Finally, get clear on your risk tolerance. Understanding how much risk you’re comfortable with will help you choose the right properties and develop a strategy that lets you sleep at night.

Get Your Finances in Order

Before you start scrolling through property listings, let’s talk about the foundation of your entire investment journey: your finances. Getting this right from the start is what separates successful, long-term investors from those who stumble at the first hurdle. Think of your financial strategy as the blueprint for your portfolio. It dictates how quickly you can grow, how you’ll handle unexpected costs, and ultimately, how profitable your investments will be. Taking the time to understand your numbers, master your cash flow, and plan for growth will give you the confidence to make smart, strategic decisions. Let’s get your financial house in order.

Know your numbers: Key metrics to track

To make smart investment choices, you need to speak the language of numbers. A great starting point is the 1% Rule, a simple guideline suggesting a property’s monthly rent should be at least 1% of its purchase price. It’s a quick way to gauge if a property has potential. Beyond that, you’ll want to calculate your Return on Investment (ROI) to measure profitability against your initial costs. Many investors aim for an ROI that beats the average stock market return, giving them a clear benchmark for success. Tracking these key metrics helps you evaluate new opportunities and monitor the health of your existing properties.

Master your cash flow

While property values can increase over time, relying solely on appreciation is a risky game. The key to a sustainable portfolio is positive cash flow. This simply means that your rental income is greater than all your expenses—mortgage, insurance, maintenance, and taxes—each month. This consistent, predictable income is what allows you to weather market fluctuations and provides the funds to maintain your properties and grow your portfolio. Focusing on what cash flow is and how to achieve it from day one will set you up for long-term stability and success.

How to build your investment fund

One of the most powerful ways to expand your holdings is by putting your properties to work for you. Reinvesting your profits is the engine of portfolio growth. This means using the positive cash flow from your rental income, or tapping into the equity you’ve built as a property’s value increases, to fund your next purchase. This strategy creates a snowball effect, allowing you to acquire more properties at a faster rate. By consistently channeling your earnings back into your investments, you can strategically grow your property portfolio and build substantial wealth over time.

Don’t forget about taxes

Your financial planning isn’t complete without considering taxes. The income you earn from rent is taxable, and understanding your obligations is essential for accurate profit calculations. You can find official guidance on paying tax on rental income to ensure you’re compliant. Beyond taxes, it’s also wise to compare your potential returns to other investment options. If a property isn’t projected to deliver a solid return that justifies the work involved, you might find that other avenues, like the stock market, offer a more straightforward path to similar financial gains. Always weigh the effort against the reward.

How to Choose the Right Properties

Adding properties to your portfolio isn’t a numbers game—it’s about quality over quantity. The right properties will generate consistent income and appreciate over time, while the wrong ones can become a drain on your finances and energy. Choosing wisely is the foundation of a successful and scalable portfolio. It requires a blend of solid data analysis and a good feel for a market’s potential. Think of yourself as a detective, piecing together clues to find investments that align with your long-term goals. This process isn’t about finding a “perfect” property, but about finding the one that’s perfect for you and your strategy. By focusing on a few key areas, you can learn to spot the deals that will propel your portfolio forward and confidently pass on the ones that won’t. Let’s walk through the essential steps for identifying properties that are worth your investment.

Do your market research

Before you even look at a single listing, you need to do your homework. Solid market research is the first and most critical step, helping you identify opportunities and steer clear of potential pitfalls. Start by defining what you want to achieve. Are you looking for immediate cash flow or long-term appreciation? Once your goals are clear, you can choose a target market and neighborhood that aligns with them. Dig into property value estimates, review historical data, and look at local economic forecasts. This groundwork will give you the confidence to know when a property is a genuine opportunity.

Analyze the location

You’ve heard it a million times: location, location, location. It’s a cliché for a reason. The location of an investment property has a massive impact on its rental income, tenant quality, and future value. Look for areas with strong fundamentals: growing job markets, good transport links, and desirable amenities like parks, shops, and schools. A property in a thriving neighborhood will attract reliable tenants and is more likely to see its value increase. Walk around the area at different times of the day to get a real sense of the community and its potential.

Assess different property types

Not all rental properties are the same. A sleek city-centre apartment will attract a different type of tenant than a three-bedroom house in the suburbs. Your choice of property should match your investment strategy and the demand in your target area. For example, if you’re investing near a university, student housing might be a great fit. If you’re in an area popular with young families, a house with a garden could be ideal. Consider the pros and cons of each, from maintenance costs to tenant turnover, to find the property type that works best for you.

Find properties with potential

A great investment isn’t just about what a property is worth today—it’s about what it could be worth tomorrow. When you’re evaluating a property, look for its potential for long-term appreciation or future development. Is it in an up-and-coming neighborhood with planned regeneration projects? Is there an opportunity to add value through renovations? Properties with strong growth potential are the ones that will truly accelerate your portfolio’s growth. This forward-thinking approach is what separates savvy investors from the rest of the pack.

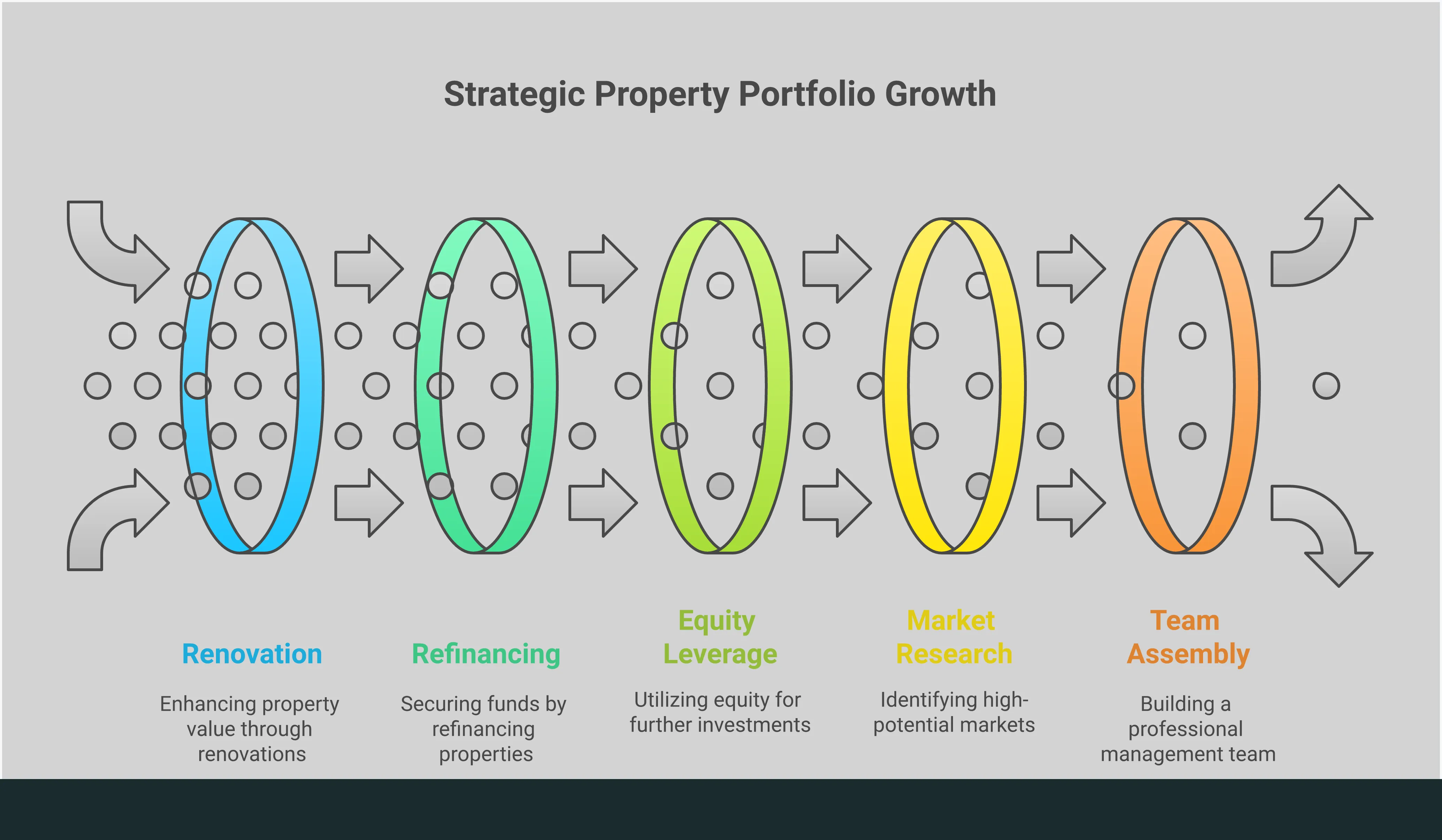

Proven Ways to Grow Your Portfolio

Once your finances are solid and you know what you’re looking for, it’s time to get strategic about expansion. Growing a property portfolio isn’t just about buying more properties; it’s about creating a cycle of growth where each investment helps fund the next. Think of it as building a snowball of assets that gets bigger as it rolls. There are several tried-and-true methods that seasoned investors use to scale their portfolios effectively. Let’s walk through a few of the most powerful strategies you can use to build momentum and achieve your long-term goals.

The BRRRR strategy

The BRRRR method is a favorite among investors for a reason—it’s a powerful engine for growth. The acronym stands for Buy, Rehab, Rent, Refinance, Repeat. The idea is to buy a property below market value that needs some work, renovate it to increase its value (this is called “forcing appreciation”), and then rent it out to tenants. Once you have a tenant and a higher property valuation, you can refinance with a lender to pull out your initial investment. This allows you to effectively leverage equity you’ve created to fund your next purchase. It’s a rinse-and-repeat strategy that can help you scale your portfolio much faster than traditional methods.

Leverage the properties you already own

Your current properties can be your greatest asset for expansion. As you pay down your mortgage and property values rise, you build equity—the difference between what your property is worth and what you owe on it. You can tap into this equity to fund your next purchase. As the American Apartment Owners Association notes, using equity to buy another rental property is one of the safest ways to expand your portfolio. You can do this through a cash-out refinance or a Home Equity Line of Credit (HELOC). This approach lets you use your existing assets to grow your portfolio without needing to save up a huge cash deposit for every new investment.

Optimize your buy-to-let strategy

Growth isn’t always about adding new doors; sometimes it’s about making your current doors more profitable. A key part of a strong buy-to-let strategy is maximizing the performance of each property. This starts with a careful evaluation of a property’s condition and potential for improvements. Smart renovations can significantly increase your rental income and the property’s long-term appreciation. This not only improves your cash flow but also builds equity faster, giving you more to leverage for future purchases. A solid rental property investment strategy also includes excellent property management to keep tenants happy and vacancies low, ensuring your assets are always working for you.

Diversify your portfolio

You’ve probably heard the saying, “Don’t put all your eggs in one basket.” This is especially true for property investment. Concentrating all your capital in one type of property or a single location can leave you vulnerable to market shifts. Diversification is your key to managing risk. This could mean investing in different types of properties, such as single-family homes, multi-family buildings, or even commercial spaces. It can also mean spreading your investments across different geographic areas. By building a diverse real estate portfolio, you can create more stable, resilient returns and protect your wealth from localized downturns, ensuring your long-term financial security.

How to Finance Your Expansion

Once you’ve found a promising property, the next big question is how to fund it. Expanding your portfolio often means looking beyond your personal savings. Luckily, there are several financing routes you can take, each with its own set of benefits. The right financing strategy depends on your financial situation, the type of property you’re buying, and your long-term goals. Let’s walk through the most common ways investors secure the capital they need to add another property to their name.

Explore traditional mortgages

For many investors, a traditional buy-to-let mortgage is the first port of call. These are similar to residential mortgages but are specifically for properties you intend to rent out. Lenders will assess your application based on the potential rental income of the property, as well as your personal financial health. Having a good credit score and a substantial down payment can help you secure more favorable interest rates. It’s a well-trodden path for a reason—it’s structured, predictable, and offered by most major banks and building societies.

Look into alternative funding

If a traditional mortgage isn’t the right fit or you need to move quickly, alternative funding might be the answer. Options like bridging loans can provide short-term capital to secure a property, often much faster than a bank. These loans use the property as collateral and are offered by private lenders. While they typically come with higher interest rates, they can be an invaluable tool for purchasing a property at auction or one that needs renovation before it can be mortgaged traditionally. They act as a ‘bridge’ to get you from purchase to long-term financing.

Consider a partnership

You don’t have to grow your portfolio alone. Partnering with another investor or working with a private lender allows you to leverage other people’s money, which can be a powerful strategy for expansion. A partnership can take many forms, from a joint venture where you pool funds and expertise to a simple loan from a private individual. This approach not only gives you access to more capital but also allows you to share the risks and responsibilities of property investment. Just be sure to have a clear legal agreement in place to protect everyone involved.

Use refinancing to your advantage

Your existing properties can be your greatest asset for funding new ones. If you have built up equity in your current portfolio, you can refinance to pull out some of that cash to use as a down payment on your next purchase. This is the core principle of popular strategies like the BRRRR method (Buy, Rehab, Rent, Refinance, Repeat). By improving a property and increasing its value, you can create new equity to reinvest. It’s a fantastic way to make your money work harder and scale your portfolio systematically without needing to save up a new deposit from scratch each time.

Protect Your Investments: Manage Your Risk

Growing your portfolio is exciting, but it’s just as important to protect the assets you’ve worked so hard to acquire. Managing risk isn’t about expecting the worst; it’s about creating a solid foundation so you can handle any bumps in the road with confidence. A smart risk management strategy helps you stay in control and ensures your investments continue to work for you over the long term. Think of it as the essential, behind-the-scenes work that makes sustainable growth possible. Let’s walk through the key areas you need to focus on to keep your investments secure.

Avoid these common pitfalls

Being a landlord isn’t always glamorous. Between dealing with difficult tenants, fixing broken appliances, and handling constant repairs, it can sometimes feel like a second job. It’s also a long-term commitment, so you might not see huge profits right away. Properties need ongoing maintenance, and that requires both time and money. The key is to go in with your eyes open. Understanding these challenges upfront allows you to plan for them, whether that means setting aside a healthy maintenance budget or working with a property management company to handle the day-to-day operations for you.

Get the right insurance

Think of insurance as your financial safety net. It’s an absolute must-have for protecting your investment from the unexpected. Standard home insurance won’t cover a rental property, so you’ll need a specific landlord insurance policy. This typically covers property damage, liability in case a tenant is injured, and sometimes loss of rental income if the property becomes uninhabitable. It’s crucial to understand your loan options and the types of insurance required to secure your financing and protect your asset. Don’t be afraid to shop around and speak with an insurance advisor to find a policy that gives you the right coverage for your specific property.

Understand the legal side

The world of property investment comes with its fair share of rules and regulations. From tenancy agreements and deposit protection schemes to health and safety certificates, there’s a lot to keep track of. Getting this wrong can lead to hefty fines or legal trouble. This is one area where professional advice is invaluable. Getting guidance from accountants and lawyers who specialize in property can help you understand your tax obligations and other legal responsibilities as a landlord. It’s a smart investment that saves you headaches and protects you from making costly mistakes down the line.

Review your portfolio regularly

Building a successful property portfolio isn’t a “set it and forget it” activity. It requires careful planning and regularly checking in on how your investments are performing. Is your rental income keeping up with the market? Are your expenses under control? Are your properties still aligned with your long-term goals? Conducting regular real estate market research is essential for spotting new opportunities and identifying potential issues before they become major problems. A quarterly or semi-annual review will help you make informed decisions and keep your portfolio on the right track for growth.

Build Your Professional Network

Growing a property portfolio isn’t something you do alone. While it’s tempting to wear all the hats yourself, especially at the beginning, scaling up requires a team of trusted professionals. Think of it as building your personal board of directors for your investment journey. These experts provide the specialized knowledge you need to make smarter decisions, avoid costly mistakes, and free up your time to focus on what you do best: finding great investment opportunities. You can’t be an expert in property law, tax accounting, and tenant management all at once, and trying to do so is a fast track to burnout.

Your network is your greatest asset. It includes the property manager who handles late-night tenant calls, the financial advisor who helps you see the big picture, and the solicitor who makes sure your contracts are solid. Investing in these relationships is just as important as investing in property itself. With the right team behind you, you can handle challenges with confidence and grow your portfolio more efficiently and sustainably. It’s about working smarter, not just harder, and surrounding yourself with people who can help you reach your goals. This support system not only protects your investments but also gives you the confidence to take on bigger and better opportunities.

Find the right property manager

Let’s be honest: being a landlord can be a tough job. One investor I know warned me about the realities of dealing with difficult tenants, replacing broken appliances at a moment’s notice, and handling constant repairs. It can quickly become a full-time role you never signed up for. This is where a great property manager becomes invaluable. They are the key to a truly passive property investment, handling everything from tenant screening and rent collection to maintenance and emergencies. This frees you from the day-to-day grind, allowing you to concentrate on strategic growth and finding your next property. A reliable manager keeps your properties running smoothly and your tenants happy, protecting your investment and your peace of mind.

Work with a financial advisor

While you might have a knack for spotting promising properties, a financial advisor helps you build a cohesive strategy for your entire portfolio. They look beyond individual deals to ensure your real estate investments align with your broader financial goals. A good advisor can help you structure your finances for growth, manage your cash flow effectively, and plan for long-term wealth creation. They provide an objective perspective, helping you create a real estate investment portfolio that is balanced and tailored to your specific needs. This high-level guidance is crucial for making informed decisions as you expand, ensuring each new property is a strategic step forward, not just an isolated purchase.

Consult with legal experts

As your portfolio grows, so does the legal and financial complexity. This is why having an experienced solicitor and accountant on your team is non-negotiable. These experts help you understand the intricate web of property law, tax regulations, and compliance requirements. An accountant can advise on the most tax-efficient way to structure your portfolio, while a solicitor will handle contracts, leases, and any potential disputes. Getting their advice early and often helps you avoid common legal pitfalls and ensures your business is built on a solid, compliant foundation. Think of it as an investment in protection—they help you keep more of your returns and steer clear of costly legal issues down the line.

Use the best tools and software

Your professional network isn’t just made up of people; it also includes the technology you use. Modern property management software can automate and streamline many of the tedious tasks that come with owning rental properties. These digital tools can help you track income and expenses, manage tenant communications, screen applicants, and analyze the profitability of potential investments. By automating these processes, you reduce the chance of human error and get a clear, real-time view of your portfolio’s performance. This efficiency gives you more time to focus on high-value activities, like researching new markets and planning your next acquisition.

Plan for Long-Term Success

Growing a property portfolio is a marathon, not a sprint. Once you’ve acquired a few properties, the real work of strategic management begins. It’s about more than just collecting rent; it’s about creating a sustainable, profitable system that works for you over decades. Thinking ahead and putting solid plans in place for performance, maintenance, and even eventual sales will protect your investments and set you up for continued growth. This is how you turn a few properties into true, lasting wealth.

Track your performance

This is where the rubber meets the road. You need to know exactly how your investments are doing to make smart decisions. Building a portfolio requires careful planning and research, and that includes regularly checking in on your numbers. Go beyond just tracking rent payments. Keep a close eye on metrics like cash-on-cash return, net operating income (NOI), and occupancy rates. A simple spreadsheet can work wonders, or you can use property management software. When you have a clear picture of your performance, you can spot which properties are your star players and which might need a new game plan.

Create a maintenance plan

Nothing eats into profits faster than unexpected, costly repairs. That’s why a proactive maintenance plan is non-negotiable. Properties inevitably need ongoing upkeep, and waiting for something to break is a recipe for stress and bigger bills. Instead, schedule regular inspections and preventative tasks, like servicing the boiler or cleaning the gutters. It’s also smart to set aside a portion of your rental income each month for a maintenance fund. This approach not only preserves the value of your asset but also keeps your tenants happy, which is key to reducing costly vacancies. A well-maintained property attracts and retains great tenants.

Know when to rebalance your portfolio

Your investment portfolio shouldn’t be a “set it and forget it” project. Markets shift, neighbourhoods change, and your own financial goals might evolve. That’s why it’s important to review your portfolio every year or so to see if it still makes sense for you. Rebalancing might mean selling an underperforming property that’s causing headaches and reinvesting the capital into a more promising area. Or, it could involve refinancing a property to pull out equity for your next purchase. Understanding your loan options and financial position is crucial for making these strategic moves and ensuring your portfolio stays aligned with your long-term vision.

Develop your exit strategy

Thinking about selling a property before you even buy it might sound strange, but it’s one of the smartest things you can do. An exit strategy is your plan for how and when you’ll eventually part ways with an investment. It gives you clarity and prevents emotional decision-making down the line. For example, you might decide to sell a property once it hits a certain appreciation target or if its return on investment drops below a specific threshold. Having these criteria in place helps you make timely decisions about properties that no longer fit your goals, ensuring your portfolio remains as profitable and efficient as possible.

How to Optimize Your Portfolio

Growing your portfolio isn’t just about buying more properties—it’s about making the ones you already own work harder for you. Optimizing your portfolio means fine-tuning your strategy to increase profits, cut down on unnecessary costs, and make smart decisions that set you up for long-term success. It’s about being an active, savvy investor, not just a passive owner. By focusing on these key areas, you can create a more resilient and profitable collection of properties that truly works for you.

Maximize your rental income

Your rental income is the lifeblood of your portfolio, so keeping it healthy is priority number one. The best way to do this is to focus on properties with strong positive cash flow—meaning they bring in more money in rent than they cost you in expenses each month. This steady stream of income isn’t just for paying the bills; it’s your primary tool for growth. One of the most powerful real estate investment tips is to reinvest your profits. By using the cash flow from your current properties to fund down payments on new ones, you create a snowball effect that can accelerate your portfolio’s expansion significantly.

Find ways to reduce costs

Just as important as what you earn is what you keep. Getting a handle on your expenses can dramatically improve your bottom line. Start by tracking every cost, from mortgage payments and insurance to maintenance and management fees. This gives you a clear picture of where your money is going. As your portfolio grows, consider using digital tools to manage rent collection and bill payments, which can save you time and prevent costly mistakes. Having a solid system for building your commercial real estate portfolio often involves this level of organization. Always maintain a healthy emergency fund for unexpected repairs so you’re never caught off guard.

Plan smart property improvements

Not all renovations are created equal. Smart improvements are strategic investments that either increase your rental income or the property’s overall value. Before starting any project, ask yourself if it will attract higher-paying tenants or significantly raise the property’s appraisal value. A popular strategy for this is the BRRRR method: Buy, Rehab, Rent, Refinance, Repeat. This approach involves fixing up a property to increase its value, then refinancing to pull out cash for your next purchase. Learning how to build a real estate portfolio effectively often means mastering this cycle of value creation and reinvestment. It’s a fantastic way to grow your holdings without needing huge amounts of new capital.

Think about market timing

While no one has a crystal ball, you can make educated decisions by paying close attention to market trends. Understanding the economic health of the city or neighborhood where you invest is crucial. Are jobs being created? Is the population growing? Are there new infrastructure projects planned? Answering these questions helps you anticipate future demand and potential appreciation. The first step in any sound investment is to research real estate markets thoroughly. Staying informed about local conditions allows you to identify opportunities and make strategic moves, whether that’s buying a new property in an up-and-coming area or selling one that has peaked in value.

Ready for More? Advanced Growth Strategies

Once you’ve mastered the fundamentals of property investment and have a few properties under your belt, you might start wondering, “What’s next?” If you’re ready to accelerate your growth and take your portfolio to the next level, it’s time to explore some advanced strategies. These approaches can help you diversify your holdings, access larger deals, and scale your operations more quickly. They often come with different risk profiles and require a solid understanding of the market, but with the right preparation, they can significantly expand your wealth-building potential. Think of this as moving from the local leagues to the nationals—the game is bigger, but so are the rewards. Let’s look at a few powerful ways to supercharge your portfolio growth.

Add commercial property to the mix

Venturing into commercial property is a classic move for investors looking to diversify beyond residential buy-to-lets. This category includes everything from office spaces and retail shops to industrial warehouses. Commercial properties often come with longer lease terms and different return calculations, offering a new dimension to your income streams. The key to success here is diligent commercial real estate market research, which helps you uncover local development trends and identify high-potential opportunities. A deep dive into the data can even point you toward distressed properties that, with the right strategy, could offer significant returns. It’s a different ballgame than residential, but one that can be incredibly rewarding.

Explore international investments

Looking beyond your home country can open up a world of opportunity. International markets can offer incredible diversification and the potential for higher returns, especially in emerging economies or established cities with strong growth. As an overseas investor, you can tap into markets you may not have otherwise considered. However, this path requires careful planning. It’s crucial to understand the local regulations, tax laws, and economic factors that will affect your investment. Working with a team on the ground that you trust is non-negotiable. They can help you research real estate markets and handle the complexities, ensuring your investment is sound and secure.

Look for joint venture opportunities

You don’t have to build your empire alone. Partnering with other investors in a joint venture (JV) is a powerful way to grow your portfolio faster than you could on your own. By pooling your capital, skills, and resources, you can access larger, more profitable deals that might otherwise be out of reach. This approach also allows you to share the risks associated with property investment. Whether you team up with a private lender or join a syndicated deal, a partnership can be one of the most effective strategies to expand your real estate portfolio. Just be sure to formalize everything with a clear legal agreement to ensure everyone is on the same page.

How to scale your portfolio effectively

Scaling isn’t just about buying more properties; it’s about doing so in a smart, sustainable way. One of the most effective methods is to use the equity from your existing properties to finance new acquisitions. As your properties appreciate in value and you pay down your mortgages, you build equity that can be unlocked through refinancing. This essentially allows you to recycle your initial capital to buy more properties. This principle is the engine behind popular methods like the BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat). By strategically using equity in real estate, you can create a snowball effect, allowing your portfolio to grow at an exponential rate.

Related Articles

- How to Grow Your Wealth Without Becoming a Full-Time Investor

- Best Ways to Invest in Real Estate: A Practical Guide | Portico Invest

- Pros & Cons of Buy-to-Let Apartment Investing | Portico Invest

- The Ultimate Guide to Buy-to-Let Property Investing | Portico Invest

- How to Build a Buy-to-Let Property Portfolio in 2024: Your Ultimate Guide

Frequently Asked Questions

I’m new to this. What’s the most important first step before buying my first rental property? Before you even think about looking at listings, get crystal clear on your finances and your goals. You need to know exactly how much you can afford to invest and what you want to achieve—are you after monthly cash flow or long-term growth? This isn’t the exciting part, but it’s the foundation for every decision you’ll make. A solid understanding of your own numbers will give you the confidence to act decisively when you find the right opportunity.

The BRRRR method sounds great, but is it realistic for a beginner? It’s definitely an advanced strategy, but it’s not out of reach for a determined beginner. The key is to not go it alone. The “Rehab” part of BRRRR can be the trickiest, as it requires accurately estimating renovation costs and managing the project. If you’re just starting out, partnering with experienced professionals who can guide you through the process is the smartest way to approach it. This helps you learn the ropes while minimizing the risk of a costly mistake.

What’s the biggest mistake you see new investors make, and how can I avoid it? The most common pitfall is underestimating the true costs of ownership. New investors often focus on the mortgage payment but forget to budget for maintenance, potential vacancies, insurance, and property management fees. This can quickly turn a promising investment into a financial drain. You can avoid this by creating a detailed budget for any property you consider and setting aside a healthy cash reserve—think 3-6 months of expenses—before you buy.

I want my investments to be as hands-off as possible. Is hiring a property manager the only way to do that? A great property manager is essential for making your investment truly passive, as they handle all the day-to-day tenant and maintenance issues. However, the buying process itself can be very time-consuming. To make the entire experience hands-off from start to finish, you can work with a company that sources properties, guides you through the purchase, and then provides full management services afterward. This creates a seamless, stress-free path to growing your portfolio.

Is it better to save up a new cash deposit for each property or use equity from my existing ones? There’s no single right answer—it depends on your goals. Saving a new deposit for each purchase is a slower, more conservative approach that keeps your risk lower. Using the equity from your existing properties, through refinancing, allows you to scale your portfolio much more quickly because you’re putting your assets to work. Many seasoned investors use a combination of both, but leveraging equity is often the key to building a substantial portfolio in a shorter amount of time.